November 05, 2020

What Is A Gold IRA?

In case you already own a traditional IRA, then a gold IRA wouldn't be a tall order to grasp. It is an IRS-approved depository of precious metals. Although ordinary IRAs reserves paper assets, Gold IRAs has precious metal coins and gold bars. It is tax-deferred and provides a way for the holder to develop a safe place for their investment.

These are only a small part of the appeal of Gold IRAs. Here is an index of all the factors why you should invest in Gold IRAs.

- Investment specialists will tell you to put your money in different portfolios, and you can easily spread your investments via Gold IRAs.

- It is the securest form of investment which implies that you will always have the peace of mind recognizing that some of your riches is safeguarded at all times.

- It can be a great source of financial benefits in times of trouble when the need for secure investment options arises.

What Are The Rules Associated With Gold IRAs?

This is probably the most wide-spread hindrance to potential investors in precious metals like gold. Gold IRAs are closely regulated and governed and following all the stipulations is crucial in ensuring that you’re not faced with unplanned for situations such as tax fines.

Many of these precepts and regulations are also meant to ensure that the precious metals you obtain are of superior quality and therefore can be viable always.

The specifics of the regulations can be accessed

here. Still, shown here are crucial regulations that you should know about:

- The gold you purchase must be .9950 or 24 karats pure

- The gold bars should be fabricated by an ISO 9000 approved refining experts such as NYMEX or COMEX.

Any bullion that you plan to add to your Gold IRA should be in the first-hand state and must not have been in circulation.

Listed below are coins that are all the rage as parts of Gold IRAs

• American Gold Eagle

• American Gold Buffalo

• Chinese Gold Panda

• Canadian Gold Maple Leaf

• Australian Kangaroo

• Australian Nugget

• Austrian Gold Philharmonic

Although some of the coins can appear in a variety of sizes, the IRS only allows one ounce, one half, one quarter, and one-tenth ounce coins to be a part of a Gold IRA. Some gold IRA providers might also sell non-IRS approved coins such as the Rosland Capital special coin collections (see example

here)

Just to cover all bases, if you are searching to increasingly grow your precious metals IRA then keep in mind of the purity provisions of different precious metals which go like this

• Silver - .999

• Palladium - .9995

• Platinum - .9995

What About The Tax Implications Of Gold Ira Investments?

This is another doubtful area that investors have regarding precious metals. Luckily, for all precious metals or gold disposed of included within your IRA, you aren’t obligated to pay any taxes on the profit in worth. Therefore, Gold IRAs are an excellent choice if you need to escape paying some taxes.

Another big advantage of Gold IRAs is that the moment you withdraw your funds after selling the gold and silver after you have reached the retirement age, you aren’t obligated to pay the usual collectible capital gain tax. As far as a traditional IRA is concerned, you will be responsible for pay tax on the money withdrawn equal to the ordinary income tax rates.

Posted by: goldinvestmentreview at

04:42 PM

| Comments (4)

| Add Comment

Post contains 579 words, total size 4 kb.

1

TheMaster of

public management south Africa is specifically designed for the individual

who is looking to upgrade their leadership and management skills, and in turn,

go on to change the world! A graduate of this programme is equipped to pursue a

career as an expert in their field.

Posted by: edforalls at December 21, 2022 05:11 AM (hIRR8)

2

A

wide variety of facilities that may cater to your day-to-day need can be found

within a short distance . Dunman Grand

virtural tour Shows a Nearby shopping centers such as Kallang Wave Mall, Paya Lebar Square, Paya

Lebar Quarters, 112 Katong, and Parkway Parade provide everything you could

possibly want or need, from places to have fun to sites to buy necessities for

everyday life.

Posted by: Dunmangrand at February 25, 2023 11:28 AM (EJ2ee)

3

A

GE remote is a multifunctional remote control that may be used to control your

satellite, cable, and DVD devices. All you have to do to program a device is

sync your GE universal remote with it. Here we can see all the procedures to

set up ge

universal remote codes. The benefit

of using a universal remote control is that it can operate multiple devices at

once, including your TV, DVD player, cable box, and satellite.

Posted by: fellowmagazine at March 14, 2023 10:47 AM (Wl95c)

4

At the heart of the Divorce Center's approach is a dedication to simplifying the divorce process.

divorce center new york ny Recognizing the myriad challenges that can arise during this difficult time, the center offers a range of services designed to streamline proceedings and provide clarity. From legal documentation assistance to mediation services, the center strives to empower individuals to make informed decisions about their futures.

Posted by: julianqueen4 at January 30, 2024 01:47 PM (J9JCX)

Hide Comments

| Add Comment

December 10, 2018

Gold Investment Advice Reviews & Tips

There are a number of ways to

hold gold. You may also put money into gold via financial items such as

options, futures and spread betting. Because gold could be utilized in several

ways.

If you're investing in gold, don't

forget that it is a commodity, and it's your choice to be certain you're not

overpaying. Since gold has found a strong bottom above $1,100 per ounce, a

reduction in the ratio would probably have to come from a rise in the purchase

price of silver. At a certain point, it can quickly become a bubble. It can be

a very useful way to diversify your portfolio. If you use gold as a portion of a larger, diversified investment program, however, it's not simply safe to own but can offer you positive

returns when the remainder of your portfolio is struggling.

There are a number of ways to

put money into gold. It could be in various forms, it may be by means of

jewelry, coins, and bars, or perhaps items you can use for various reasons. It

has been the topmost preference by several buyers and hobbyists. It is far too

expensive to use in the industrial process. Buying gold from Noble Gold is a safe place

to commence investing in Gold.

People are likely to turn to

gold, in a huge way, all over the world. Contemplating the simple fact that

gold is extremely expensive, people frequently consider silver as a secondary

solution for jewelry. It has proven its resilient change for a lot of

occasions. If you purchase gold for the appropriate reason as a long-term

savings vehicle then you wish to purchase the best-known bullion products for

the lowest possible rates.

When you purchase Gold, you

put money into an asset class that's as old as civilization itself. Gold has

been shown to be an effective hedge against inflation at nearly every price.

Not that it is an easy game to play, especially for short-term speculators.

Because it has an unparalleled combination you are able to participate in.

Before you commence buying gold or silver, it's important to comprehend

different forms each one can arrive in.

If you believe gold is the

very best precious metal to put money into, think again. Gold is among the extraordinary relics on earth. While gold and silver are definitely the most

common precious metals to get, there are others to consider too.

Gold jewelry pieces have been

in tradition from the very earlier time. It is still in the trend because of

its ravishing and dazzling

designs. You can wear gold jewelry pieces in any occasion you want. Pure gold

isbvery soft which is why for

different designing jewelry pieces, jewelry makers alloy other metals like silver, nickel and many others

with gold to give it the proper density. But solid gold jewelry is quite expensive. Gold is not only

used as jewelry but sometimes it is a good medium of exchanging goods and things and also a very good

investment. A gold jewelry piece looks spectacular on any occasion.

For daily use, one can choose

simple gold jewelry like a simple single gold chain, small earrings. These also looks great for daily

work life. There is also some gold jewelry that is simple, yet you can wear

them and look absolutely classy.

For heavier ones, you will get numerous design and style of gold jewelry.

Gold jewelry designs are

appealing and eye-catchy. As gold is softer in the comparison of other metals, one can bring more vitality

and do detailed and fine works in the jewelry piece. A gold necklace is connected with many chains and

interlinks with different stones and countless precise and fine design to form a necklace.

A gold

necklace can be up to 30 inches too. Still in most of the countries and regions

for wedding jewelry gold is first

preference and a token of blessing.

Posted by: goldinvestmentreview at

06:10 AM

| Comments (15)

| Add Comment

Post contains 658 words, total size 4 kb.

1

I’m wondering why the opposite

specialists of this sector accomplish not take in this

Posted by: JefferyIToussaint at September 25, 2020 05:36 AM (WLrat)

2

When businesses have short-term or temporary projects,

investing in brand-new servers may not be cost-effective. Cheap used servers

provide a budget-friendly solution Cheap Used Servers for meeting project requirements without

committing to long-term investments. Refurbished servers are often compatible

with a wide range of operating systems and software, making them versatile and

adaptable to various IT environments. This compatibility can reduce the need

for extensive software adjustments when integrating these servers into existing

infrastructure.

Posted by: cloudninjas at October 19, 2023 07:15 AM (rB5Ga)

3

Affinity

Serangoon Showflat also caters to families with children. The development

offers family-friendly amenities such as children's play areas, family swimming

pools, and affinity serangoon showflat recreational spaces where families can bond and create lasting

memories. Sustainability

Initiatives: Affinity Serangoon Showflat places a strong emphasis on

sustainability. Green building practices, energy-efficient systems, and

eco-friendly features are integrated into the development.

Posted by: affinityatserangoon at October 24, 2023 05:17 AM (rB5Ga)

4

What sets the Crystal bling 6000 apart is its ability to

seamlessly blend style and substance. The exterior of this gadget is a work of

art, with meticulously placed crystals that turn heads wherever you go. It's

not just about the bling; it's about the craftsmanship that goes into creating

a piece of technology that is as much a fashion accessory as it is a tool for

everyday life.

Posted by: DisposableVape at November 08, 2023 10:27 AM (EPGwh)

5

The journey of Tornado 7000 from concept to reality involves

a collaboration of brilliant minds in the tech industry. Engineers, scientists,

and visionaries come together to harness the potential of this groundbreaking

technology. The development process includes rigorous testing, refinement, and

an unwavering commitment to ensuring that randm tornado 7000 not only meets but

exceeds the expectations set for it.

Posted by: randmtornado at November 11, 2023 06:25 AM (EPGwh)

6

Furthermore, the Crystal Pro Max 4000 stands out for its

commitment to environmental sustainability. Manufactured with eco-friendly

materials and designed for energy efficiency, this device aligns with the

growing awareness of environmental responsibility among consumers. The

incorporation of recyclable components and adherence to green manufacturing

practices contribute to a reduced ecological footprint.

Posted by: ninjavapes at November 11, 2023 10:52 AM (EPGwh)

7

Embark on a journey of luxury living as you explore the offerings of

affinity Singapore a residential development that epitomizes sophistication in the heart of the city. The name "Affinity" conveys a sense of connection, and this theme resonates throughout the development, from its architectural design to the thoughtful amenities that foster a sense of community.

Posted by: affinity at serangoon at November 22, 2023 03:43 AM (bInI5)

8

In one-bedroom units, for example, prospective residents might find a well-designed open-concept living and dining area, a fully equipped kitchen with high-end appliances,

the continuum floor plan and a master suite with an attached bathroom. Balconies or terraces might also be featured, offering residents the opportunity to enjoy outdoor spaces with scenic views.

Posted by: thecontinuums1 at November 22, 2023 10:31 AM (hr6sw)

9

Goldfish enthusiasts and aquarists are captivated by the vast array of

goldfish breeds available, each possessing its unique charm and characteristics. One prominent goldfish breed is the common goldfish (Carassius auratus), recognized for its vibrant orange coloration and sleek, streamlined body. Another popular variety is the Comet goldfish, distinguished by its long, flowing tail fin that resembles a comet's tail, adding an elegant touch to aquariums. Shubunkin goldfish, with their calico-like patterns and bright colors, are also highly sought after by collectors seeking a visually dynamic aquarium.

Posted by: mustpets at December 02, 2023 12:20 PM (kNncQ)

10

The court may grant the divorce once these matters are

settled. No-fault divorces simplify the legal process by eliminating the need

to prove fault grounds. How to get a No Fault Divorce in New York It's advisable to consult with a family law attorney to

navigate the specific requirements and ensure a smooth resolution.

Posted by: julianqueen4 at December 15, 2023 10:12 AM (FLr13)

11

In the expansive world of vaping, our vape wholesale platform stands out as the best place to buy bulk disposable vapes in the UK. Whether you're a retailer looking to expand your inventory or an individual vaper eager to stock up, our wholesale offerings provide a comprehensive and efficient solution.

Posted by: vapeonlinestore at December 21, 2023 09:39 AM (2bOns)

12

he Staff Selection Commission Combined Graduate Level (SSC CGL) examination is conducted to recruit candidates for various Group B and Group C posts in various government ministries, departments, and organizations. The SSC CGL exam is divided into four tiers. Here is a broad overview of the SSC CGL syllabus for each tier

Posted by: careerwill at January 08, 2024 10:34 AM (QXZQ1)

13

Navigating through the city's labyrinthine streets, one encounters the ever-changing face of commerce. Markets burst with the colors and aromas of fresh produce, vendors haggling and customers bargaining for the best deals. In contrast, sleek shopping malls beckon those seeking a curated,

word conuter and air-conditioned retail experience. The dichotomy of traditional markets and modern malls reflects the city's ability to embrace both its rich heritage and the forces of globalization shaping its future.

Posted by: thewordcount at January 22, 2024 10:05 AM (qIJjH)

14

Experience a luxurious retreat within the bustling cityscape at Normanton Park The development's carefully planned layout ensures that residents can escape the urban hustle and find solace within their private haven.

Posted by: normantonpark at January 26, 2024 01:41 PM (5YLME)

15

Looking to enhance your Android gaming experience? Look no further than LDPlayer, your ultimate solution for seamless gameplay on your PC. Download LDPlayer for Android Games today and unlock a world of immersive gaming possibilities.

Posted by: Ldplayer at February 02, 2024 04:04 AM (yZ3Jv)

Hide Comments

| Add Comment

December 01, 2018

How the Gold Price Drop is Making People Buy Like Crazy

Gold price has dropped just recently. The

market has become bearish. In investment decisions it is when the market is

bearish that most investors stock their investment items since it is the time

to buy items cheaply. When the market becomes bullish this is the time to

dispose of investment items to make a killing of profits.

Therefore, it is natural for investors to

rush to buy investment items during such moments. However, it is not a straight

decision to be made.

This decision depends on many factors, key

amongst them being:

1. Why the bearish market has come

about?

2. The nature of the item

experiencing bearish market

3. Future projections in the minds

of the buyers

Why the Bearish Market Has Come About?

Why has there been a gold price drop? This is

highly speculative. However, there are several factors at hand, among them;

Falling prospects of the Chinese economy. China is known to have an

overzealous appetite for metals, gold being no exception. In recent years,

it has been consistently projected that the double-digit growth of the

Chinese economy has reached its peak and it can only start falling.

Indeed, statistics in the last three years have testified this as Chinese

economy has failed to reach or surpass the miraculous 10% growth rate.

With a falling economy so is the declining appetite for metals thus

lowering demand for gold in the international market.

Hard economic times in US and some EU countries. Due to hard economic times, some

countries have had to stop piling up their gold reserves. Indeed, most

European countries have not only stopped piling up gold reserves due to

their declining purchasing power, but some have indeed thought of or in

the process of offloading these reserves. Both effects have had an impact

on global gold prices.

Fiscal and monetary policies of major economies, mainly the

US. In recent times the US Federal

Reserve system has established monetary policies that have tended to ease

demand for gold in the US such as lowering interest rates.

The Nature of The Particular Item Experiencing Bearish Market – GOLD

Gold is not just any other item, not just any

other metal. When prices of non-precious metals fall, people don’t rush over in

masses to buy them. However, gold is unique and thus when its price is low

people would rush to buy it due to the following reasons:

- It

is a store of value

- It

has ornamental value

- It

has sentimental value

Why Are People Buying Like Crazy – Speculation!

Buyers would rush to buy an item whose price is

low if, in their minds, they do project a brighter future for the item in terms

of profit margins. Gold has been known to fall and rebound resoundingly.

Therefore, many investors believe that a fall in gold price is only short-term

and thus they are willing to grab this opportunity with both hands and invest a

lot of money in buying gold as they speculate they can make huge amount of

profit in the very near future.

Posted by: goldinvestmentreview at

06:07 AM

| Comments (3)

| Add Comment

Post contains 521 words, total size 4 kb.

1

it might not be a taboo subject but generally people are not enough to speak on such topics.

Posted by: DarleneDWhite at September 25, 2020 06:04 AM (WLrat)

2

This is an interesting thread about the market of gold! It even included certain histories regarding the market of the product. While taking time or breaks with this discussion, there are these games called Among Us and this sequel to gacha life. Among Us is a pretty interesting game as it requires the players to lie to one another and play with us game. Gacha on the other hand, allows you yo be creative with the avatar you’re going to be using exploring various environments!

Posted by: John Favors at October 15, 2020 09:04 AM (O1Gme)

3

One crucial aspect of wealth protection is the ability to accurately assess and appraise the value of diverse assets. High net worth divorce attorneys

High Net Worth Divorce Attorney in New York bring extensive experience in dealing with various financial instruments, business valuations, real estate holdings, and investment portfolios.

Posted by: julianqueen4 at January 12, 2024 09:25 AM (CLnzp)

Hide Comments

| Add Comment

November 25, 2018

Beginners tips for investment in Gold

When you are thinking about how to invest in gold, you

have a great deal of options to consider. Many people choose gold investment

opportunities because they come with many benefits. If you are thinking about

this type of strategy, here are a few things you may wish to consider.

Perhaps one of the biggest considerations

when investing in precious metals is your motivation or reason. If you are

investing to speculate, you will want to check the market carefully. A

speculator is not usually investing for the long term.

Speculators buy something, wait for the price

to go up, and then sell. However, speculating is another form of gambling and

does come with an element of risk.

Yet, some people feel that great risks can

sometimes deliver great rewards. On the other hand, huge risks can also spell

disaster for the new and inexperienced investor.

Some people choose precious metal investing

as a means of savings. This can be a good idea when the average savings account

is yielding minimal returns. It is a relatively safe form of investing when

done this way, as the price remains stable over short and medium term and is

very likely to go up for the long term.

Gold Investment Tips – Beginning Gold Investors

If you are just a beginner, it may be a good

idea to invest in gold to diversify your portfolio. For example, you may have

some risky investments in the stock market or perhaps in commodities. Using a

relatively safe form of investing will help to balance out the risk factor and

give you a more stable financial situation.

Coins or bullion are the best way to invest

if you are a newbie. This is the easiest form to understand. Bullion and coins

are something you can see and hold in your hand and are very stable.

Futures offer a lot of opportunities. If you

trade in futures it is like investing in commodities. You can have an excellent

way to leverage your money and this can be a good way to earn substantially

more than with other opportunities.

Your money may be leveraged by investing on

margin. Yet, this can be very risky, and it is best for newcomers to refrain

from futures until more experience is gathered, in addition, this market is

complex, and a beginner may get lost or easily make a mistake.

You may think about investing in gold coins

that are considered rare or collectible. This is a good way to make money.

However, the value on these coins can fluctuate a great deal and one must be

very careful and not invest heavily in the beginning.

However, some coins like the British Sovereign

can provide you with an investment that is not subject to capital gains.

No matter what kind of investing one chooses,

it is best to do your homework. When it comes to gold, stick with something you

can understand in the beginning. Avoid speculation until you have more

experience.

Get professional advice before you invest

your hard-earned money. This type of assistance just might be the most valuable

part of your gold investment.

Posted by: goldinvestmentreview at

06:04 AM

| Comments (2)

| Add Comment

Post contains 530 words, total size 4 kb.

1

this really answered my problem, thank you!

Posted by: MariaSFrierson at September 25, 2020 06:13 AM (WLrat)

2

Wow this is huge. I mean how many people actually have that

a lot of money to be able to invest in gold? I mean gold is not nothing. It’s

gold! Come to think of it, I too is investing in gold but my gold is actually

more of computer games specifically among us pc download – chrome. It’s a

mindblowing discover and I think its value can be equated to gold. Hey why don’t

you try to download among us pc too?

Posted by: callie at October 15, 2020 05:44 PM (ZZCqa)

Hide Comments

| Add Comment

November 20, 2018

Gold Investment Tips for Beginners

Becoming

an investor is not an easy walk in the park. However, just like any normal

baby, it is frequent attempts to make a step that eventually leads to a walk.

Therefore, ordinarily, anyone can become a gold trader. However, to avoid

common pitfalls that beset many, expert advice from those who have walked the

path is essential.

The

following are important gold investment tips for beginners;

1.Get to understand why

you are investing in gold

2.Invest in gold when

need arises

3.Balance your investment

portfolio

4.Seek professional

advice

5.Keep track of the

performance of your preferred investment option

Get

to understand why you are investing in gold

There

are thousands of investment options available in the market. Gold is just one

of them. Why would you like to invest in gold? The following are some of the

common reasons that drive people to invest in gold;

- Universality – Gold is universally recognized as

a standard measure of value. Therefore, you can easily store your wealth in

gold form and be able to convert it into any currency that you desire.

- Stability – Gold, being a rare and precious

metal, hardly fluctuates to extremes and is always on an upward trend.

- Safety – Gold, as a measure and store of

value, hardly depreciates unlike most international currencies and many

other investments.

Invest

in gold when need arise

Investment

in gold should not be an impulse affair but a well-planned and determined

affair as gold is expensive and unlike other securities, it has high handling

risks. Furthermore, its disposal is not as fluid as cash and cash equivalents.

Therefore, it is important to determine whether you are a short-term investor

or a long-term investor. Investing in gold is suitable for long-term investors

as opposed to short-term investors.

Balance

your investment portfolio

Like any other investment, you should

remember the saying"never put all

your eggs into one basketâ€! Therefore, it is extremely prudent to spread

your investment to minimize risks of total failure. As a rule of thumb, it is

generally recommended that you put between10% and 30% of your investment in

gold and spread the rest to other investments.

Seek

professional advice

When

it comes to the sheer number of investors who have been conned, nothing matches

the number of investors who have been conned in gold business. Therefore, no

matter how sweet or urgent the deal seems, be patient and prudent enough to

seek professional advice. You can easily get advice from reputable gold dealers

in your market. However, for unbiased and professional advice, seek the expert

advice of treasury consultants.

Following

the above tips, you can successfully make profit in the gold investment market.

Posted by: goldinvestmentreview at

06:01 AM

| Comments (2)

| Add Comment

Post contains 450 words, total size 4 kb.

1

I came on this while searching on google I’ll be sure to come back.

Posted by: EugeneDRedd at September 28, 2020 02:11 AM (bVqZk)

2

Wow,

nice post! These are all tips which are helpful for beginners like me. But

instead of gold, I would love to invest digitally, like on some games or

applications. You know, I’ve found Among Us and I want something similar to it.

This game is fun and super exciting to play. If you want to know how to play

this game, you may download it for free. You can play this with your friends,

colleagues, classmates, and family members.

Posted by: zoey at October 18, 2020 04:40 AM (PIbqH)

Hide Comments

| Add Comment

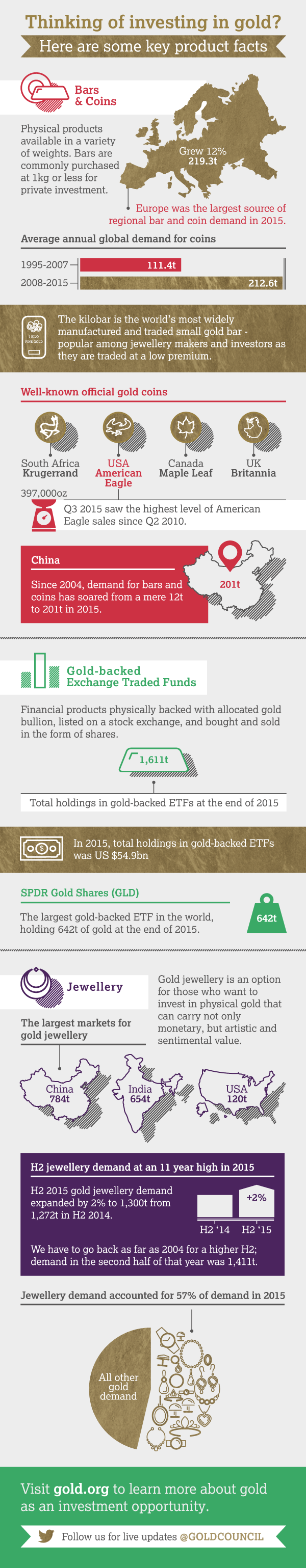

November 01, 2018

Thinking of investing in gold?

See This Infographic For Details:

Posted by: goldinvestmentreview at

05:58 AM

| Comments (23)

| Add Comment

Post contains 10 words, total size 1 kb.

1

thanks for

share..more wait .. …

Posted by: TimothyMLay at September 28, 2020 02:09 AM (bVqZk)

2

When it comes to buying gold, I would prefer dealing with someone

who has a proven track record of being honest and risk-free when transacting

with gold. I would suggest going to a place like among us game pc and this website https://among-us.io/. I heard

that their service is pretty stellar they have gotten rave reviews from their

regular customers. They often offer a popular game along with every gold

transaction that they have with you. It is really nothing more than a gesture

of good faith but it is a nice touch when it comes to customer service and

satisfaction.

Posted by: yamatocannon at October 16, 2020 08:13 PM (1j2Bc)

3

Esports https://qnnit.com/redecor-codes/ Awards are considered the most respected award

ceremonies held in the industry. The award ceremony features awards to

acknowledge the excellent personalities working in the various fields of

Esports. These fields include awards for live streaming and the individuals who

perform countless efforts for the areaThe

Streamer Award of the Year held great importance as it’s a holy grail any

stream can get. These awards were introduced in 2016, and since then, it has

been the most significant achievement any streamer could get worldwide. The

list of people who won the "Streamer Award of the Year†title includes some

huge names like Dr. Disrespect, "Ibai†Llanos, and Dr. Disrespect.

Posted by: qnnit at November 16, 2022 10:23 AM (Xike7)

4

Kubera

Fantasy is an Indian fantasy

Sports platform with good market popularity and over 20 Lakh+ Downloads. It is

one of the Best Fantasy Platform Where Users can play various sports like

Cricket & Kabaddi.

Posted by: sportsfantasyapps at November 21, 2022 06:32 AM (st+Pv)

5

The H1B level 1 salary is the lowest wage a foreign worker can pay while working in the United States under the

h1b salary,H1B visa program. The salary of this level is valued at between $38,000 and $51,000 per year.

Posted by: h1bsalary at November 22, 2022 12:04 PM (st+Pv)

6

Not

necessarily. The job itself must require a bachelor's degree or higher in a

specialized field. You must then have that degree to qualify for h1b data H-1B

status.

Posted by: h1bsalary at November 25, 2022 09:17 AM (jRsw/)

7

Do

you want to know everything about Bazi Destiny Analysis? It is said that Bazi bazi destiny analysis is more important when the destiny analysis is supportive and invigorating for

everyone. For this, you could consider a Bazi Destiny Analysis.

Posted by: yimodernfengshui at November 25, 2022 11:04 AM (jRsw/)

8

pullman residences showflats Homes (Previous Dunearn Nurseries) is a Freehold,

Marked Private Improvement situated off Scotts Street. The quick area is

encircled via landed homes and elevated structure condos, with numerous

legitimate schools (Old English Chinese School (Essential), Old English Chinese

School (Junior) and Holy person Joseph Foundation) situated inside a 1km sweep

and Pullman Homes is only 2 Minutes Stroll from Newton MRT.

Posted by: pullman residences showflats at November 30, 2022 10:01 AM (Ohjqn)

9

Mazdaspeed 3 High-Tension Fuel Siphon (HPFP) Internals for both the Mazdaspeed3 and Mazdaspeed 6 took north of 2 years of innovative work to bring advancement you can depend on in your Speed3 and Speed6. The CorkSport Max Stream Fuel Siphon Internals have the best in market solidifying surface medicines, high strength coatings, and a machined resilience. Our

Mazdaspeed 3hpfpInternals will give you the most exhibition that anyone could hope to find for your dollar. We make these fuel siphons with accuracy machining strategies, we then, at that point, treat the surface and coat it for strength, lastly machine the internals again for an ideal fit that gives your Mazdaspeed super high productivity.

Posted by: Mazdaspeed 3 hpfp at December 07, 2022 05:50 AM (MFYS0)

10

Go Gauge is an

International Freight Forwarding & Transportation Company covering various

industries such as Energy, Steel, Power, Oil & Gas, Infrastructure, Automotive

and Rail sectors. Freight Logistics Companies Our business is to provide integrated logistics services such

as Project Cargo Management Solutions, Factory Decommissioning Solutions,

International Freight Management, Customs and Cross Border Movement, Heavy and

Over-Dimensional Cargo Movement, etc. Go Gauge provides end-to-end visibility

using cutting-edge technologies throughout the entire supply chain.

Posted by: Freight Logistics Companies at December 10, 2022 11:48 AM (HnXEm)

11

Long long island university brooklyn Island College, established in 1926, keeps on

reclassifying advanced education, giving top notch scholastic guidance by

a-list workforce. Perceived by Forbes for its accentuation on experiential

learning and by the Brookings Foundation for its "esteem added" to

understudy results, LIU offers almost 250 degree programs, with an organization

of north of 280,000 graduated class that incorporates industry pioneers and

business visionaries across the globe.

Posted by: long island university brooklyn at January 12, 2023 08:40 AM (G4Ezp)

12

One of the UK's top state funded colleges, Northumbria

College has a rich history tracing all the way back to 1880 and northumbria university ranking was conceded

college status in 1992. With in excess of 34,000 understudies selected from 140

ethnicities, Northumbria is a well known decision with global understudies

applying to concentrate on in the UK.

Posted by: ischoolconnectz at January 20, 2023 12:18 PM (UQ+7t)

13

what do you do if your fire system doesn't work? you don't want to be in the position where you need to leave your business premises unguarded and at risk of fire. If you are caught out with your system breaking down, then you will need to act quickly to make sure that your premises are kept safe and that your insurance will continue to cover you. For more details :

Read more

Posted by: Firewatchguards at February 23, 2023 06:34 AM (6/6lZ)

14

Wular Lake in Jammu and Kashmir is one of the largest

freshwater lakes in Asia and ramsar sites in india an important habitat for resident and migratory

bird species. It also plays a significant role in flood regulation and acts as

a source of livelihood for local communities engaged in fishing and

agriculture. Conservation efforts focus on wetland restoration, conservation

education, and sustainable resource management.

Posted by: testbookx at May 26, 2023 05:54 AM (rB5Ga)

15

Notwithstanding the Bareshell Manors themselves, Anant Raj

Home offers a scope of local area conveniences that improve the general

residing experience. luxury villas in gurgaon Occupants can appreciate perfectly arranged gardens,

sporting spaces, and shared offices, for example, clubhouse, pools, sports

courts, and wellness focuses. These conveniences advance a feeling of local

area and give open doors to unwinding, diversion, and social collaborations.

Posted by: anantrajestat at August 02, 2023 06:07 AM (rB5Ga)

16

Text banking allows you to

retrieve your account information via text messages. payslip download To set up text banking,

you'll need to link your mobile number to your bank account and follow the

provided instructions. Once set up, you can send a specific text message to

your bank's designated number to receive your account balance and other account

details in seconds.

Posted by: howtofillx at August 17, 2023 12:19 PM (rB5Ga)

17

The Atul Maheshwari Scholarship, a prestigious initiative, offers a valuable opportunity for students to pursue their educational aspirations. This scholarship serves as a stepping stone for deserving candidates by providing financial support and recognition for their academic endeavors. In addition, for those seeking admission in Maharashtra schools through the RTE (Right to Education) quota, the online application form and lottery details for rte maharashtra admission online form. This initiative plays a pivotal role in promoting accessible and quality education for all, making a significant impact on students' futures.

Posted by: Xelavin Dsoza at August 20, 2023 07:09 AM (uoNeY)

18

Bionics Enviro Tech is a leading

player in the field of sewage

wastewater treatment, specializing in the production of Nanozyme bioculture. Their innovative

solutions are applied across various industries and have a nationwide presence,

effectively addressing challenges related to sewage wastewater treatment, sewage disposal treatment, sewage and effluent treatment, as

well as wastewater treatment. With

a strong emphasis on research and development, their commitment to innovation

shines through, offering a wide array of Nanozyme technologies.

Their focus primarily revolves

around COD and BOD reduction, zero sludge processes, and the elimination of

pollutant loads. They cater to industries worldwide, encompassing Effluent

Treatment Plants (ETP), Sewage Treatment Plants (STP), Common Treatment Plants

(CETP), and Anaerobic Digesters (AD) of any scale and across various sectors. Bionics

Enviro Tech boasts an exceptional track record in the treatment of wastewater,

making them a trusted partner in addressing wastewater challenges.

Posted by: bionicsenvirotech at October 09, 2023 09:17 AM (RCLD0)

19

To file for divorce in New York, one or both spouses must

meet the state's residency requirements. When is Divorce Final in New York At least one spouse must have lived in

New York for a continuous period of one year immediately before filing for

divorce, or both parties must have resided in New York for at least six months

before filing.

Posted by: jonymarry6 at November 07, 2023 11:02 AM (iopCn)

20

The advantages of hiring a traffic lawyer are manifold. Beyond their legal expertise, these professionals often have established relationships within the legal system, including with prosecutors and judges. This network can prove invaluable when negotiating on behalf of their clients for reduced penalties or alternative resolutions.

virginia beach traffic lawyer

Posted by: Charlotte at December 08, 2023 12:10 PM (Nfcaa)

21

Awesome article, Very interesting to read this article, I would like to thank you for useful had made for writing this superb article share with us.

protective order virginia firearms

Posted by: Isabellazz at December 22, 2023 08:21 AM (fxXYb)

22

They conduct thorough investigations, gathering evidence and witness testimonies to build a strong case.

criminal solicitation of a minor Crafting a tailored defense strategy, they challenge the prosecution's evidence and narrative, often negotiating plea deals to secure reduced charges or lesser penalties. If the case proceeds to trial, the attorney advocates fiercely on behalf of their client, presenting a compelling defense and cross-examining witnesses.

Posted by: arthisri at October 09, 2024 01:05 PM (nSg8v)

23

In Virginia, reckless driving is considered a serious offense and carries significant penalties. It is classified as a Class 1 misdemeanor, which can result in a fine of up to $2,500 and a possible jail sentence of up to 12 months. In terms of points, a conviction for reckless driving adds 6 points to your driving record.

how many points is reckless driving in virginia

Posted by: graysonking5 at October 29, 2024 08:21 AM (al92w)

Hide Comments

| Add Comment

70kb generated in CPU 0.0579, elapsed 0.0887 seconds.

37 queries taking 0.0767 seconds, 112 records returned.

Powered by Minx 1.1.6c-pink.